5 Tips for a Successful and Low Stress First Rental Property Investment

The key to avoiding stress while starting your low stress rental property journey is to approach the process with confidence and smart strategies. Sure, doing anything for the first time can be stressful. It’s a big investment, especially when buying your first rental home. But you really can make it happen without overwhelming stress.

Here are my top 5 tips for a low stress and successful first rental property investment.

Advice is OK, but Do Your Own Research

Take courses, read investment books, attend seminars, or find other ways to gain confidence. I suggest focusing on learning how to select locations, evaluate properties, and understand the rental market. Your success depends on your research and making smart decisions. A low stress investment begins with buying in the right area and doing due diligence.

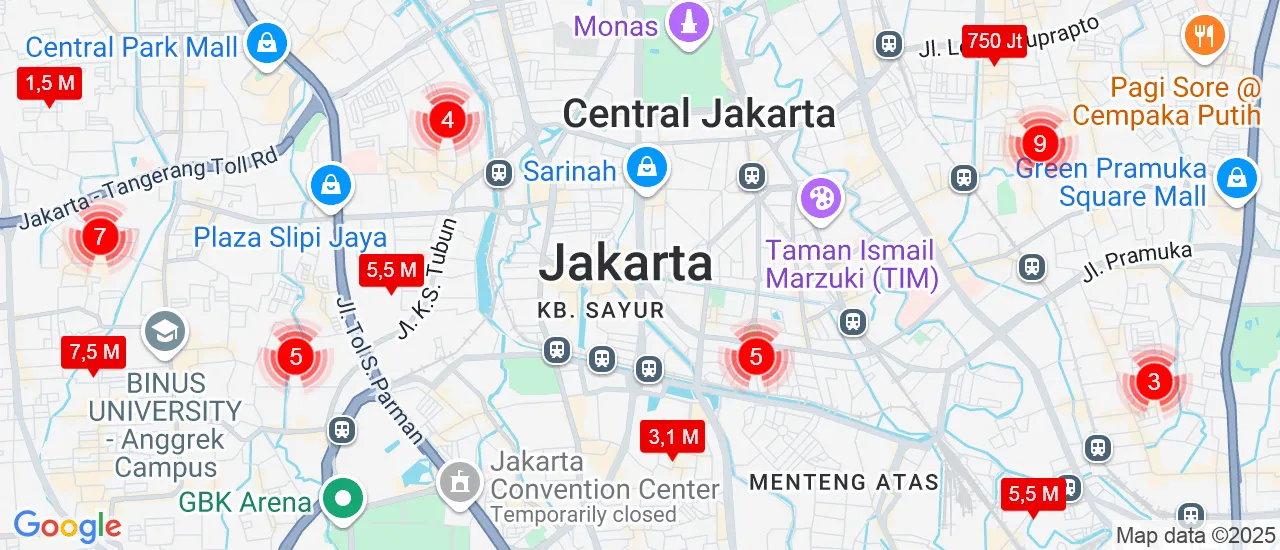

Your first rental property investment is best done in your area of residence, where you know what’s going on economically. You want to know that the economy will support today’s decision into the future, as this isn’t a short term strategy. Understand who the major employers are, what drives people to move in or move away, and if things look good into the near future.

Don’t Just Rely on Real Estate Agents for a Low Stress Transaction

Sure, now and then you can work with a real estate agent who handles foreclosures and get a good deal. Remember though that these will be “listed” foreclosures on the MLS, Multiple Listing Service. You and all of your competitor investors have access to the same information, so competition will likely drive up your cost of acquisition.

It’s best to buy your first rental property in your own area. You’ll already have an understanding of the local economy, this helps ensure that your investment will thrive in the long term. Understanding key factors like local employers, moving trends, and overall economic health is crucial. This knowledge will lead to a low stress and successful property investment.

Know What Will Rent and for How Much

Check with property managers and look at similar properties in the area. Compare rental prices to see if the market is strong. You want to have realistic expectations for rental income and vacancy rates. This helps reduce low stress by understanding what to expect from your investment.

LRT - The Premier MTH, Lantai 12 No unit 16, View : Stasiun Cawang.

Jl. MT Haryono Kav. 25-26, Tebet Timur, Tebet, Jakarta Selatan, Jakarta Selatan, DKI Jakarta

Lantai 12 No unit 16 View Stasiun Cawang 1 Kamar Tidur Ruang Tamu Ruang Makan Lantai Homogenous tile Dinding Dinding beton ringan ...

Call on ads, drive around, talk to landlords as if you’re a tenant. The most important thing for you to know before the next tip is what you can reasonably and conservatively expect for rental income and low vacancy. For example, let’s say you’re investing in a $150,000 home with a $32,500 down payment. If your mortgage payments leave you with a manageable cash flow of $250/month over expenses, you’re looking at a solid return on investment with relatively low stress.

Get the Right Financing & Cash Flow

You need to know all of your costs, including estimating repairs and other maintenance costs. But, the mortgage is going to be your largest cash outlay, so it is your most important cost consideration. You’ll need to put 20% down or more in most cases. For a rental unit you may also pay a slightly higher mortgage interest rate, a great credit history helps in this regard.

Get a firm handle on all of your costs, then see what your mortgage payment with taxes and insurance escrowed will be. Let’s use an example of a $150,000 home with a $32,500 down payment and closing costs. If you can manage to clear even $250/month over cash out of pocket, your return on the actual cash invested is going to be around 9%.

Lock in Equity at the Closing Table

NEVER buy at retail market value. If you can’t get the home at a 10-20% discount to its current market value, don’t do the deal. You want to leave the closing table with that equity as either future profit or a cushion should you have to sell before your initially planned liquidation date.

If you’re going to work with a wholesaler who you may meet at a local investment club, be clear that you’ll want to see their valuation calcs and you’ll check them with your own. You give them your requirement. If it’s 15% below market value, then they will know what they have to deliver.

Source : huffpost